Marti Figueres

My Information

LinkedIn

Resume

GitHub

Contact Information

Email: martifigueres0912@gmail.com

Phone: (469) 352-7733

Quick Navigation

About Me

Welcome! I am a senior at Lehigh University, pursuing a dual Bachelor of Science degree in Chemical Engineering and Integrated Business and Engineering (IBE) Finance, with a minor in Economics. I am part of the competitive IBE Honors Program, where I apply a multidisciplinary approach to solving complex engineering and financial challenges.

Portfolio

Here are a few of my academic and personal projects that reflect my interests in data science, finance, and engineering:

Lazy Prices Project

This project replicates and extends the findings of the Lazy Prices paper, which argues that financial markets underreact to subtle but informative language changes in 10-K filings. Using a comprehensive dataset of S&P 500 firms from 1993–2024, we implemented an end-to-end NLP pipeline to quantify textual similarity in annual filings and examine its relationship with stock returns.

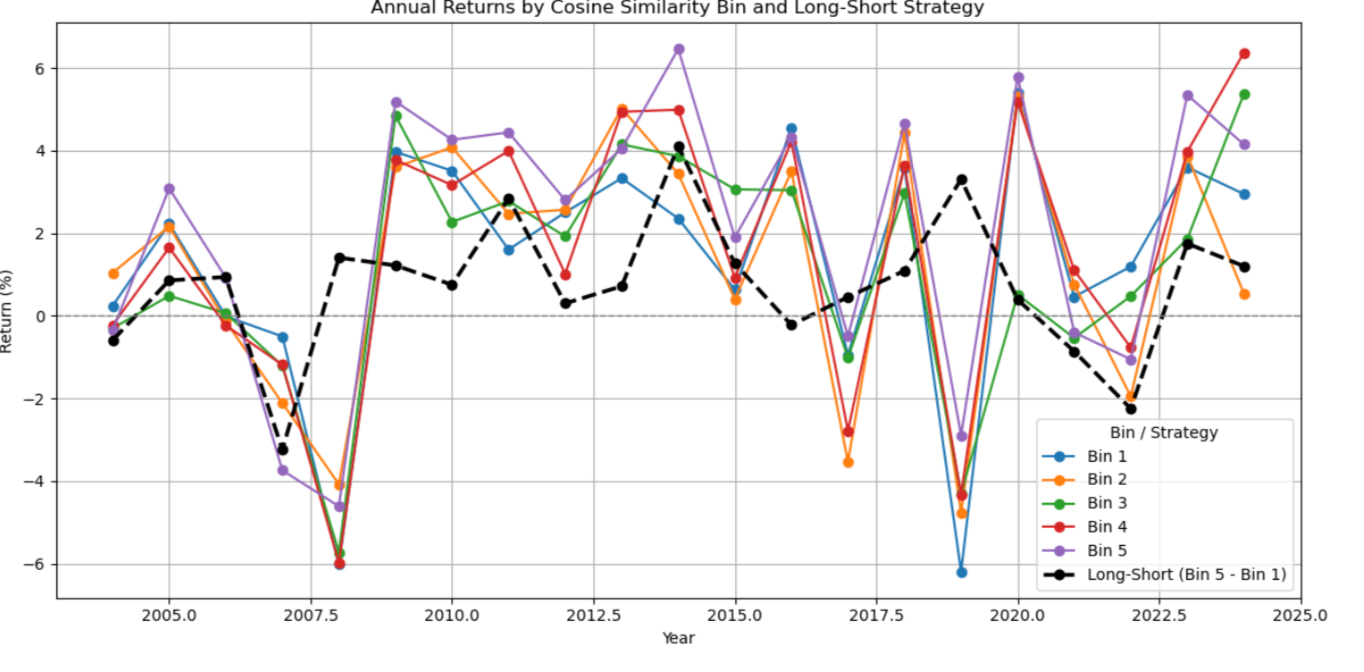

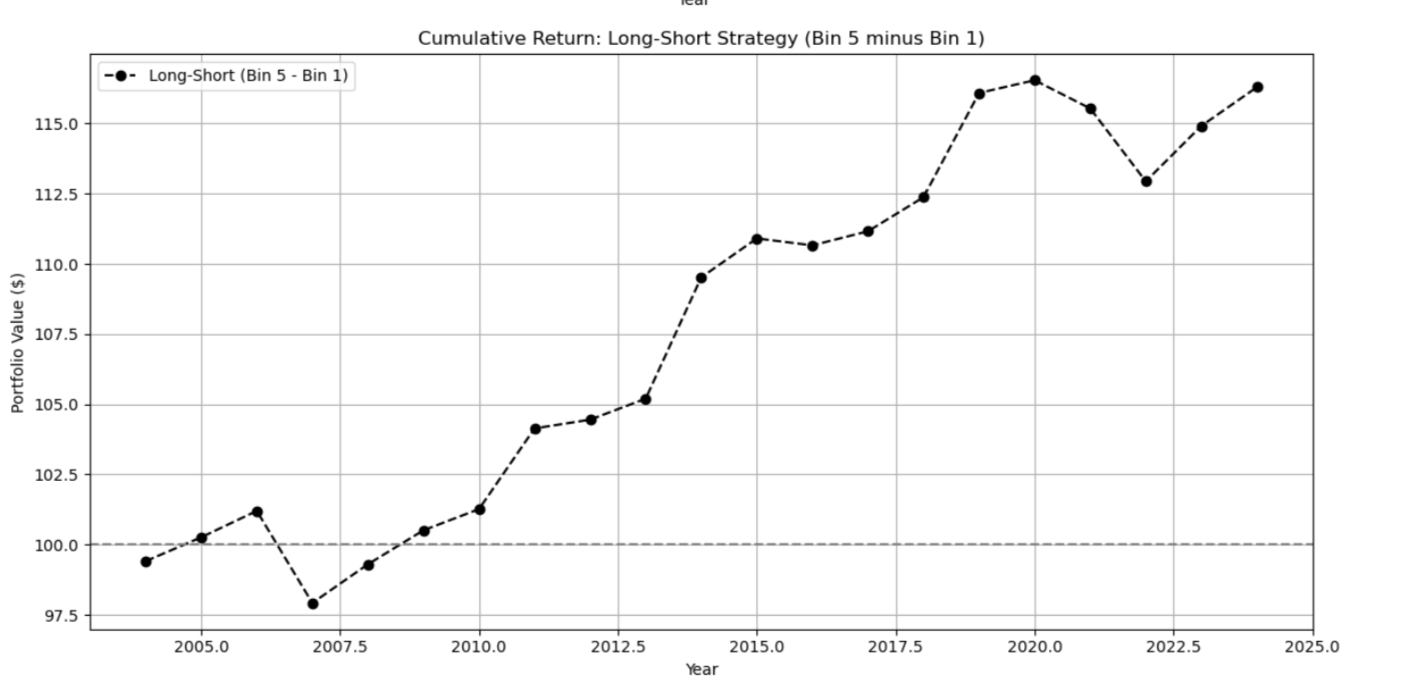

We used the Loughran-McDonald 10-K dictionary to extract word frequencies, computed cosine similarity between consecutive years’ filings, and merged these similarity measures with return data. Firms were ranked annually into five bins based on filing similarity—ranging from high-change (Bin 1) to low-change (Bin 5).

Key Finding: Firms with the most consistent disclosures (Bin 5) exhibited the highest long-term returns, supporting the idea that stability in language reflects lower perceived risk. Contrary to some expectations, firms with moderate or even low similarity still occasionally outperformed, suggesting the relationship is nuanced and not strictly linear.

Visual Results

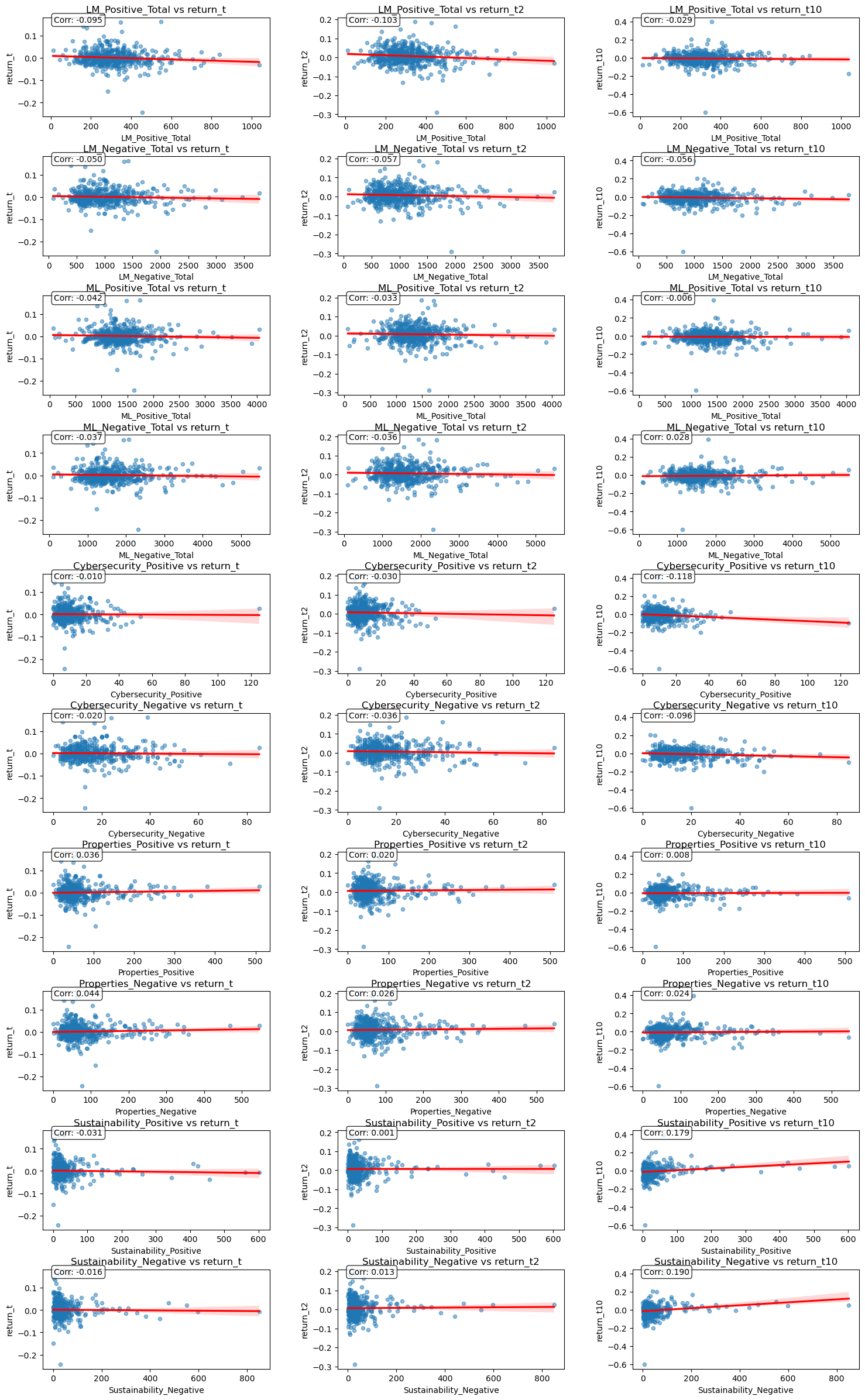

Natural Language Processing on 10-Ks: Identifying Risk

Applied NLP techniques to SEC 10-K filings to extract sentiment and identify risk-related language. Combined textual analysis with financial return data for empirical validation.

Regression Interpretation

This project investigates residential housing prices through a combination of exploratory analysis and regression modeling. We analyzed over 80 variables from 1,941 home sales (2006–2008) to identify key price drivers. Strong predictive performance (R² = 0.828) was achieved by emphasizing structural features such as overall quality and living area over time-based variables.

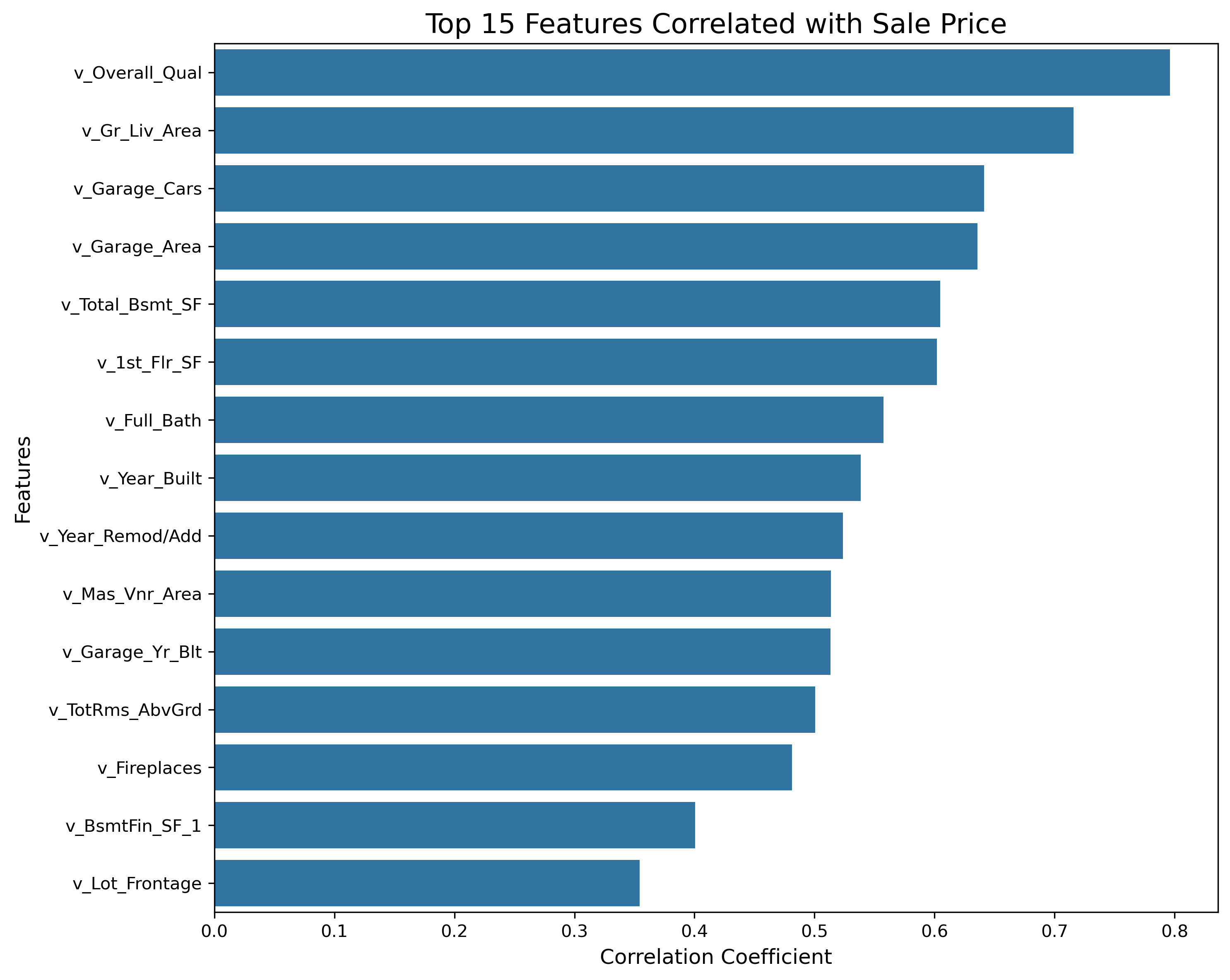

Two core visualizations reinforce the insights:

- Quality Impact: Homes with higher overall quality ratings command substantial price premiums.

- Feature Correlation: Variables like

v_Overall_Qual,v_Gr_Liv_Area, andv_Garage_Carsshow the strongest linear relationship with sale price.

Our findings highlight the effectiveness of log-log regression specifications in capturing non-linear relationships in housing market data.

Career Objectives

I aim to work at the intersection of engineering, finance, and data analytics, particularly in roles that involve energy systems, technology strategy, or investment strategy. My goal is to apply both technical rigor and financial insight to solve meaningful, real-world problems.

Hobbies

Outside of academics, I enjoy:

- Trivia Nights

- Learning about and trying new types of cheese (I’m a proud member of the Cheese Club)

- Traveling

- SCUBA Diving

- Fitness

- Reading about innovations in the pharma/energy industry

Last updated: May 2025

Page template forked from evanca